Cha Eunwoo Faces Scrutiny Over Allegations of Tax Evasion and LLC Operations.

- Authorities find no business activity at registered LLC location.

- Eel restaurant has been closed since Cha's military enlistment.

- Previous tax investigation revealed Cha’s obligations exceeding $14 million.

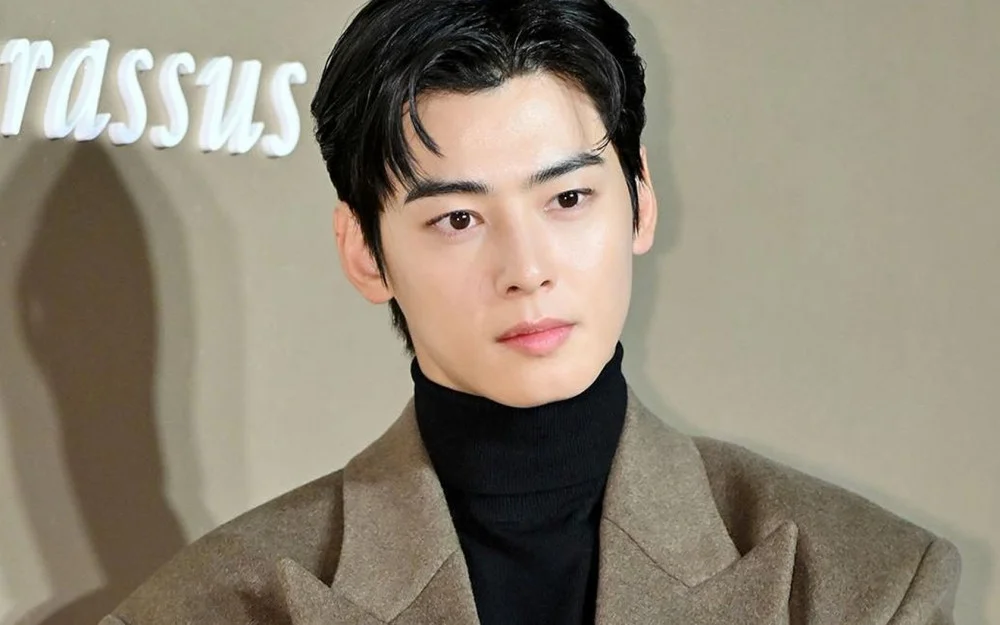

ASTRO member Cha Eunwoo is facing renewed scrutiny as allegations of tax evasion have come to light. The controversy centers on a limited liability company (LLC) registered under his name at the location of a grilled eel restaurant in Ganghwa County, operated by his mother. On January 26, 2026, Ganghwa County officials conducted a field inspection of the company, only to find no office, equipment, or facilities for business operations.

Coincidentally, the LLC applied for an address change to Gangnam District on the same day, completing the transfer immediately. This day also marked Cha Eunwoo’s first public statement regarding the controversy while he is currently serving in the military.

The eel restaurant, which opened in 2020, had been closed for remodeling since Cha Eunwoo enlisted in July 2025. The renovations were halted, leaving the premises vacant and unsuitable for corporate activity. Officials emphasized that the site lacked basic office infrastructure, making it impossible to confirm it was functioning as a business location.

Cha Eunwoo’s Two LLCs Under Investigation Amid Alleged Tax Evasion Controversy

Cha Eunwoo reportedly owns two LLCs. The one registered at the eel restaurant operates as a popular culture and arts planning business, while the second company remains unregistered. Authorities are reviewing the operations of both businesses as part of the ongoing investigation.

This is not Cha Eunwoo’s first tax-related issue. Last year, he was investigated by the Seoul Regional Tax Office on suspicion of tax evasion. Recently, the National Tax Service reportedly notified him of additional tax obligations exceeding ₩20 billion KRW (approximately $14 million USD).

The case has attracted extensive media coverage, highlighting concerns over corporate transparency, proper registration, and compliance with tax regulations. As investigations continue, the public and industry observers are closely watching how the situation unfolds for the high-profile K-pop star.

- What allegations is Cha Eunwoo facing?

Cha Eunwoo is facing allegations of tax evasion related to a limited liability company registered under his name.

- What is the nature of the LLC associated with Cha Eunwoo?

The LLC is registered at a grilled eel restaurant in Ganghwa County, operated by his mother, and is described as a popular culture and arts planning business.

- What did officials find during the inspection of Cha Eunwoo's LLC?

Officials found no office, equipment, or facilities for business operations at the LLC's registered location.

- What significant event occurred on January 26, 2026, regarding Cha Eunwoo?

On January 26, 2026, Ganghwa County officials inspected the LLC, and Cha Eunwoo made his first public statement about the controversy while serving in the military.

- What previous tax-related issue has Cha Eunwoo encountered?

Last year, Cha Eunwoo was investigated by the Seoul Regional Tax Office on suspicion of tax evasion.

- What is the current status of Cha Eunwoo's businesses?

Authorities are reviewing the operations of both of Cha Eunwoo's LLCs as part of the ongoing investigation into the tax evasion allegations.